The Power of Prepayment Options

Michael Hallett • March 2, 2016

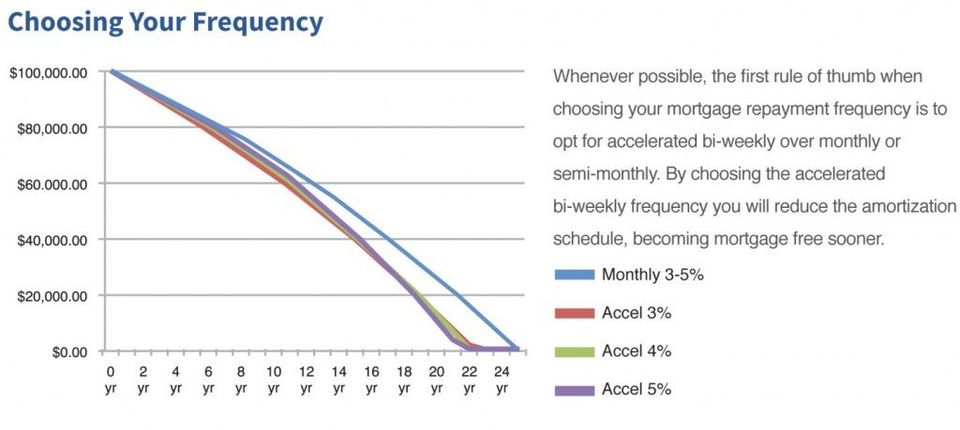

Do you have a Mortgage Action Plan (MAP)? If not, it's time to plan your road MAP to mortgage free living. Every lender provides options, but very few take advantage of them. These mortgage benefits are called PREPAYMENT OPTIONS. The 3 most common prepayment options are: adjust the frequency at which the payments are made (weekly, semi-monthly, bi-weekly, monthly and accelerated), increase the monthly payment amount (there is a maximum monthly percentage) and lump sum (or balloon, also a maximum percentage of the original mortgage balance) payment. Make sure you know how to utilize them to the fullest and what your maximum amounts are. Don't feel obligated to maximize the prepayment options but at the very least make extra payments, your retirement savings will thank you later.

Only 32% of all mortgage borrowers exercise their contractual right to make significant efforts to accelerate repayment, including taking one or more of the following actions in the past year:

- 16% have voluntarily increased their monthly payments.

- 15% have made a lump sum (balloon payment) contribution to their mortgage.

- 6% have adjust or increased their payment frequency.

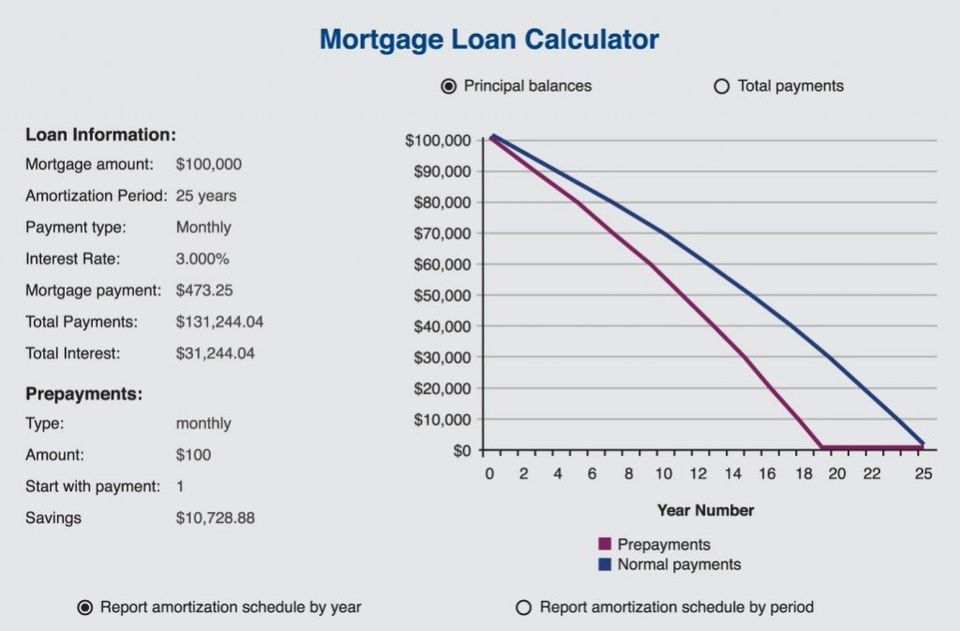

Monthly Increase Payment

If choosing an accelerated bi-weekly repayment schedule does not work for your plan, then maybe you might be able to consider adding an extra principal payment to your regular monthly mortgage commitment. The graphic below illustrates how the principal amount is reduced when utilizing the monthly increase prepayment option. By adding $100 to your monthly mortgage you can save $10,729 in interest and reduce the life or the mortgage by 5.9 years.

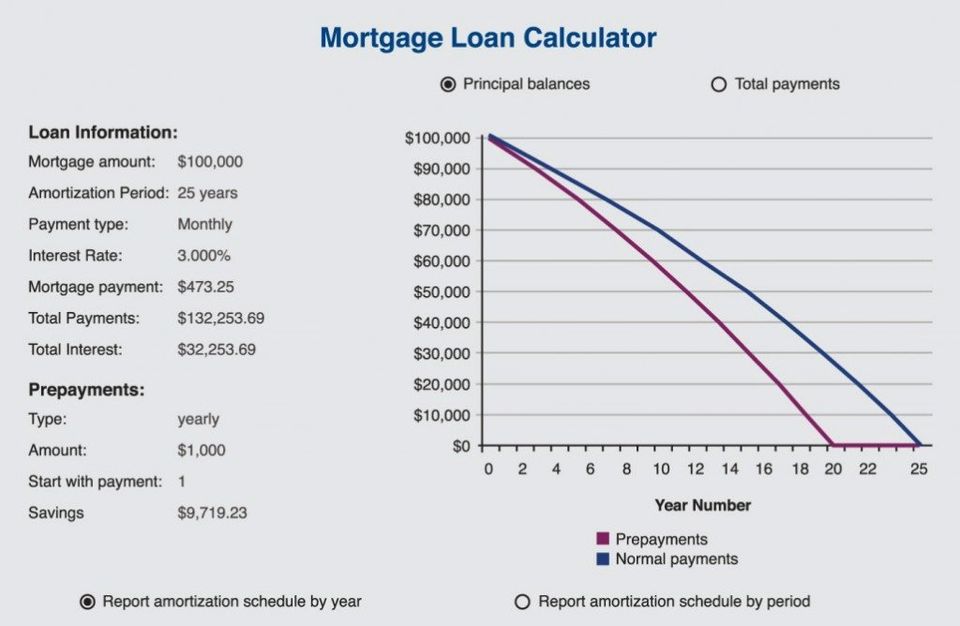

Annual Lump Sum or Balloon Payment

The last prepayment option you can utilize to pay down your mortgage sooner is called Balloon payment. You are contractually allowed to pay up to make annual payments on the anniversary date. The graphic below shows a $1,000 balloon payment. An annual contribution of $1,000 will reduce your mortgage by 5.2 years and save you $9,719 in interest.

My Personal Scenario

You are likely asking yourself right now, so what does Michael's road MAP look like. Well, I'm happy to share that with you. My current lender allows me to increase my monthly payments by 15%, make a annual lump sum payment of 15% (of the original mortgage balance) and/or double up my contractual minimum monthly commitment. I have elected to exercise my contractual right to utilize the 15% monthly increase to the maximum. My monthly contractual payment is $2,074.98. By maximizing the 15% monthly increase my adjusted payment is $2,386.23 which is an extra $311.24 per month. If I had decided to only make the minimum monthly payments of $2,074.98 then the life of my mortgage would be 25 years remaining at the end of this current term (maturing July 2017). However, with the extra payment of $311.24 per month I've effectively reduced the life of my mortgage to (currently) 21 years 2 months, even less when it matures in 17 months. If I were to keep maintaining the same course of action as above for the entire life of the mortgage the revised amortization would be reduced from 30 years to 15 years 9 months saving me $114,827.94 in interest.

Why not join the 32%ers elite club?! The contribution can be minimal and usually unnoticeable on a day-to-day basis, the pay-off is years sooner though. The power of making extra payments is overwhelming. Ask me how to increase your equity position. Your bank account will thank me later.

SHARE

MY INSTAGRAM

Mortgage Brokering meets mountain biking and craft beer. A couple months ago I set for a bike ride with the intention of answering few mortgage related questions, mission accomplished. Any good bike ride pairs nicely with a tasty beer which we enjoyed @parksidebrewery. Hope you see the passion I have for brokering, biking and beer. @torcabikes #mountainbikingmortgagebroker

TEASER alert...at thats what I think they call it in the business. Years ago a wrote a blog called BEERS BIKES AND MORTGAGES. I some how (in my head) blended all 3 topics into 1 blog. Simply put, I enjoy aspects of all 3 with each of them providing something different. I re-united with the talented Regan Payne on a project that I think will shed a bit more light on who I am and what I do. #craftbeer #mountainbike #mortgagebrokerbc #dlccanadainc

I saw this hat on Instagram, that very moment I knew I needed it. As a BC boy born and bred The Outdoorsman hat needed to be added to my collection. As someone who loves BC and most things outdoor, I’m now glad I have a cool hat to wear and fly the flag of BEAUTIFUL BRITISH COLUMBIA. It will be in my bag for all post-exploration celebratory cold pints. If you want to check them out or add one to your collection go to @nineoclockgun ...and yes my facial hair matches the hat as well.

View more

Bank of Canada maintains policy rate at 2¼%. FOR IMMEDIATE RELEASE Media Relations Ottawa, Ontario January 28, 2026 The Bank of Canada today held its target for the overnight rate at 2.25%, with the Bank Rate at 2.5% and the deposit rate at 2.20%. The outlook for the global and Canadian economies is little changed relative to the projection in the October Monetary Policy Report (MPR). However, the outlook is vulnerable to unpredictable US trade policies and geopolitical risks. Economic growth in the United States continues to outpace expectations and is projected to remain solid, driven by AI-related investment and consumer spending. Tariffs are pushing up US inflation, although their effect is expected to fade gradually later this year. In the euro area, growth has been supported by activity in service sectors and will get additional support from fiscal policy. China’s GDP growth is expected to slow gradually, as weakening domestic demand offsets strength in exports. Overall, the Bank expects global growth to average about 3% over the projection horizon. Global financial conditions have remained accommodative overall. Recent weakness in the US dollar has pushed the Canadian dollar above 72 cents, roughly where it had been since the October MPR. Oil prices have been fluctuating in response to geopolitical events and, going forward, are assumed to be slightly below the levels in the October report. US trade restrictions and uncertainty continue to disrupt growth in Canada. After a strong third quarter, GDP growth in the fourth quarter likely stalled. Exports continue to be buffeted by US tariffs, while domestic demand appears to be picking up. Employment has risen in recent months. Still, the unemployment rate remains elevated at 6.8% and relatively few businesses say they plan to hire more workers. Economic growth is projected to be modest in the near term as population growth slows and Canada adjusts to US protectionism. In the projection, consumer spending holds up and business investment strengthens gradually, with fiscal policy providing some support. The Bank projects growth of 1.1% in 2026 and 1.5% in 2027, broadly in line with the October projection. A key source of uncertainty is the upcoming review of the Canada-US-Mexico Agreement. CPI inflation picked up in December to 2.4%, boosted by base-year effects linked to last winter’s GST/HST holiday. Excluding the effect of changes in taxes, inflation has been slowing since September. The Bank’s preferred measures of core inflation have eased from 3% in October to around 2½% in December. Inflation was 2.1% in 2025 and the Bank expects inflation to stay close to the 2% target over the projection period, with trade-related cost pressures offset by excess supply. Monetary policy is focused on keeping inflation close to the 2% target while helping the economy through this period of structural adjustment. Governing Council judges the current policy rate remains appropriate, conditional on the economy evolving broadly in line with the outlook we published today. However, uncertainty is heightened and we are monitoring risks closely. If the outlook changes, we are prepared to respond. The Bank is committed to ensuring that Canadians continue to have confidence in price stability through this period of global upheaval. Information note The next scheduled date for announcing the overnight rate target is March 18, 2026. The Bank’s next MPR will be released on April 29, 2026. Read the January 28th, 2026 Monetary Report

Mortgage Registration 101: What You Need to Know About Standard vs. Collateral Charges When you’re setting up a mortgage, it’s easy to focus on the rate and monthly payment—but what about how your mortgage is registered? Most borrowers don’t realize this, but there are two common ways your lender can register your mortgage: as a standard charge or a collateral charge . And that choice can affect your flexibility, future borrowing power, and even your ability to switch lenders. Let’s break down what each option means—without the legal jargon. What Is a Standard Charge Mortgage? Think of this as the “traditional” mortgage. With a standard charge, your lender registers exactly what you’ve borrowed on the property title. Nothing more. Nothing hidden. Just the principal amount of your mortgage. Here’s why that matters: When your mortgage term is up, you can usually switch to another lender easily —often without legal fees, as long as your terms stay the same. If you want to borrow more money down the line (for example, for renovations or debt consolidation), you’ll need to requalify and break your current mortgage , which can come with penalties and legal costs. It’s straightforward, transparent, and offers more freedom to shop around at renewal time. What Is a Collateral Charge Mortgage? This is a more flexible—but also more complex—type of mortgage registration. Instead of registering just the amount you borrow, a collateral charge mortgage registers for a higher amount , often up to 100%–125% of your home’s value . Why? To allow you to borrow additional funds in the future without redoing your mortgage. Here’s the upside: If your home’s value goes up or you need access to funds, a collateral charge mortgage may let you re-borrow more easily (if you qualify). It can bundle other credit products—like a line of credit or personal loan—into one master agreement. But there are trade-offs: You can’t switch lenders at renewal without hiring a lawyer and paying legal fees to discharge the mortgage. It may limit your ability to get a second mortgage with another lender because the original lender is registered for a higher amount than you actually owe. Which One Should You Choose? The answer depends on what matters more to you: flexibility in future borrowing , or freedom to shop around for better rates at renewal. Why Talk to a Mortgage Broker? This kind of decision shouldn’t be made by default—or by what a single lender offers. An independent mortgage professional can help you: Understand how your mortgage is registered (most people never ask!) Compare lenders that offer both options Make sure your mortgage aligns with your future goals—not just today’s needs We look at your full financial picture and explain the fine print so you can move forward with confidence—not surprises. Have questions? Let’s talk. Whether you’re renewing, refinancing, or buying for the first time, I’m here to help you make smart, informed choices about your mortgage. No pressure—just answers.